The Prenuptial

Agreement that

helps you

stay married.

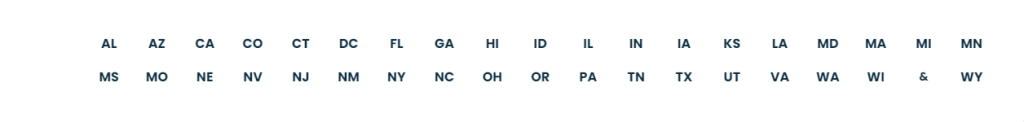

We have licensed attorneys drafting prenup and postnup agreements in more than 30 states:

Take control of your

happily ever after.

We all want that happily ever after. We want “til death do us part”. You don’t just want to stay married, you want to stay happily married to the person you chose to wed.

Modern marriage is tricky.

Money is the number one source of arguments for married couples. And it’s not getting any easier.

The average couple spends more time on the wedding invitation list than how they’ll merge their finances.

Selecting the right financial structure for your marriage is critically important, but it’s hard to find help.

Many couples comeback from their honeymoon with a long list of unresolved questions.

It’s true what they say:

The most common arguments are about money.

Marriage is the most important legal contract you'll ever sign, but no one has read it! The average couple getting married in the 1960s had one bank account between them, no real property, no credit cards, no student loans, no retirement or brokerage accounts, and one job. Today, the average couple has 8-10 bank accounts, 6-7 credit cards, equity in a property, multiple retirement accounts, tens of thousands in student loans, multiple vehicles, two jobs, and possibly a business, brokerage accounts, and inheritance. It is important to combine your financial lives fairly to avoid a messy end to a marriage, which can cost tens of thousands of dollars and have a devastating impact on each spouse's life, children, and financial future.

The most common arguments are about money.

Money disagreements are preventable.

We’ve developed a plan for you to get married and structure your finances in a way that avoids the most common confusion and

arguments couples have when it comes to their finances.

There’s a surprising solution: The Prenup.

Often maligned, and seen as planning for the end of the marriage before it begins, or as a tool only for the ultra-wealthy, you can use this contract to lay the financial foundation for a happy marriage.

We’ll provide you with a customized playbook that eliminates the confusion about relationship finance, ensures you and your spouse have agreed to a fair plan for managing your money, and gives you the tools to plan for a long marriage together.

Get married smart.

Eliminate Confusion. Get Aligned. Enjoy Marriage Worry-Free.

The Prenup Prescription gives you the financial foundation for a happy marriage:

- Start your marriage with complete financial transparency.

- Prevent the most common marriage-ending arguments.

- Incorporate a structure that works for both spenders and savers.

- Prevent the most common marriage-ending arguments.

- Build a financial life together, while still maintaining autonomy over personal spending.

- Develop a plan that will grow with you, with annual checkins to course-correct when needed.

- Adopt tools to plan for your exciting financial goals: the first house together, a child, travel, and more.

- An insurance policy that protects against expensive litigation if disaster strikes.

As featured on several

nationally recognized podcasts!

Before finding Aaron other lawyers that I met with were terrible. Thank goodness I found him because working with Aaron was an absolute pleasure! I cannot recommend his firm enough. He was super easy to work with and made the process of getting a prenup very manageable.

- S. L., Client

Aaron was exactly what I was looking for when I needed help drafting up a prenuptial agreement. He sat down with me and asked me exactly what I was looking for and advised on several blindspots I had not considered. Most importantly he educated me throughout the whole process which I thoroughly enjoyed. I’ll be recommending Aaron to my friends who need help with their prenuptials.

- D. T., Client

Aaron was exactly what I was looking for when I needed help drafting up a prenuptial agreement. He sat down with me and asked me exactly what I was looking for and advised on several blindspots I had not considered. Most importantly he educated me throughout the whole process which I thoroughly enjoyed. I’ll be recommending Aaron to my friends who need help with their prenuptials.

- D. T., Client

Aaron is incredibly thorough and is surely one of the very best at what he does. He was also very invested on a personal level and actually cared for my well-being beyond his responsibilities as my lawyer. I was so impressed by him as my legal representation and as a person.

- A. S., Client

We provide you with the best

Prenup Process

SCHEDULE A CONSULTATION

WITH US TODAY

Find out how to write a prenup that

will help you stay married, happily.

Easy, convenient scheduling.

We provide cost savings.

We understand that couples may be looking for ways to save money when it comes to planning for their future, and that's why we specialize in prenups and postnups. With our expertise, we are able to provide cost savings that you won't be able to find anywhere else.

Prenuptial Agreement customized by family law expert

$10,000

3 hours of Free Revisions and

Negotiations

$1,500

Annual Financial Check-In Worksheet, premarital Conversation Starters, and Other Resources

$1,000

Total Retail Value

$12,500

Actual Cost*

$3,500

For high-net-worth individuals (athletes, entertainers, 7-figure+ business owners,

etc.) we have a platinum package that starts at $10,000.

Getting married is the

most important financial decision

you’ll ever make - don’t leave this up to chance.

It is important to be mindful of the financial decisions you are making before and after the big day.

Yes, a prenup is the best protection that you can have against an expensive and messy dissolution of your marriage. But it’s also the best tool to avoid the financial arguments that often appear during the marriage itself.

I’m convinced that this is the best tool you can give yourself against a messy end of a marriage with your spouse. The average marital dissolution case costs $15,000 per spouse. The average case takes over a year to complete. Couples that go to court routinely spend 20% of their net worth fighting over who gets the majority of the remaining 80%. Hopefully, you don’t need to be convinced that a messy divorce is best avoided at all costs.

Today, the average wedding costs $25,000.

What could be a better gift than investing in the future happiness of your relationship with your spouse?

Most of us don’t regret investing in one of the most important days of our lives.

But it’s also important to invest in what comes after the wedding day. The cost of a prenup is a fraction of the cost of actually getting married, and will continue to pay dividends long after the wedding cake is gone.

CONSULTATION

Initial Investment

- Receive FREE resources and PDF guides

- 1-hour with a Marital Finance Specialist

- Tools to set you and your spouse on the right path

- You get all of the benefits whether you hire our services or not

CONSULTATION

Initial Investment

- Receive FREE resources and PDF guides

- 1-hour with a Marital Finance Specialist

- Tools to set you and your spouse on the right path

- You get all of the benefits whether you hire our services or not

PRENUP PREPARATION

Additional Payment

- No hidden cost

- Follow up consultations

- Up to 3 hours of revisions and negotiations

- 3 hours covers 90%+ of all clients’ costs

We will be happy to draft

your postnup

The entire process takes less than a month - for most couples, around 2 - 3 weeks.

Need separate representation?

If you are already married, we can still help you!

The law requires we only represent one spouse - if your fiancé or spouse needs representation, we can provide a list of referrals. But most jurisdictions don’t require the involvement of a second attorney.

We’ll provide a list of referrals.

We have a network of attorneys across the United States

We will be happy to draft your postnup.

Quick

Turnaround

Times.